By Lisa Rogers On the 8th of August 2022, the team visited Pipalyatjara for the week to support the community with the introduction of power charging. This was a long drive - 716 KM to be exact! Energy Education Worker Petria worked with us all week and she really...

Power Charging Begins in Mimili

By Jenny Turner Power charging began in Mimili Community on Tuesday 19 July 2022. Each household was issued with a welcome pack. This included two smart meter cards and other education materials for people to top up their power. On Monday, our star Energy Education...

Power Charging Begins in Pukatja

By Lisa Rogers Power charging started in Pukatja on Tuesday 12 July 2022. The team spent the whole week in Pukatja supporting the community through the change. We had a team of Energy Education Workers who worked over the week. This was a big week and we are very...

Energy Education Worker Spotlight – Irene Peters

Employee Name: Irene Peters Residential Community: Yalata How long have you been with the Pawa Atunmankunytjaku team? Since early November What does your job entail? Learning more about power and doing house visits in my community. Who and what inspired you to join...

Energy Education Worker Spotlight – Sofie Lee Rice

Employee Name: Sofie Lee Rice Residential Community: Amata How long have you been with the Pawa Atunmankunytjaku team? June 2021 What does your job entail? Teaching community members about the paid power project that is coming in July 2022. My favourite...

Energy Education Worker Spotlight – Fiona Moore

Employee Name: Fiona Moore Residential Community: Yalata How long have you been with the Pawa Atunmankunytjaku team? November 2021 What does your job entail? Door knocking and speaking to members of my community about paid power. Who and what inspired you to join the...

Energy Education Worker Spotlight – Kieren Van Horen

Employee Name: Kieren Van Horen Residential Community: Kenmore Park How long have you been with the Pawa Atunmankunytjaku team? September 2021 What does your job entail? Going around the communities telling people about paid power coming in Who and what inspired you...

Home visits begin in Yalata

By Lucas de Lastic In the middle of November, our newly trained team of Energy Education Workers (EEWs) completed the first round of house visits in Yalata Community. We would like to thank our EEWs for an amazing job with the team managing to speak to most of the...

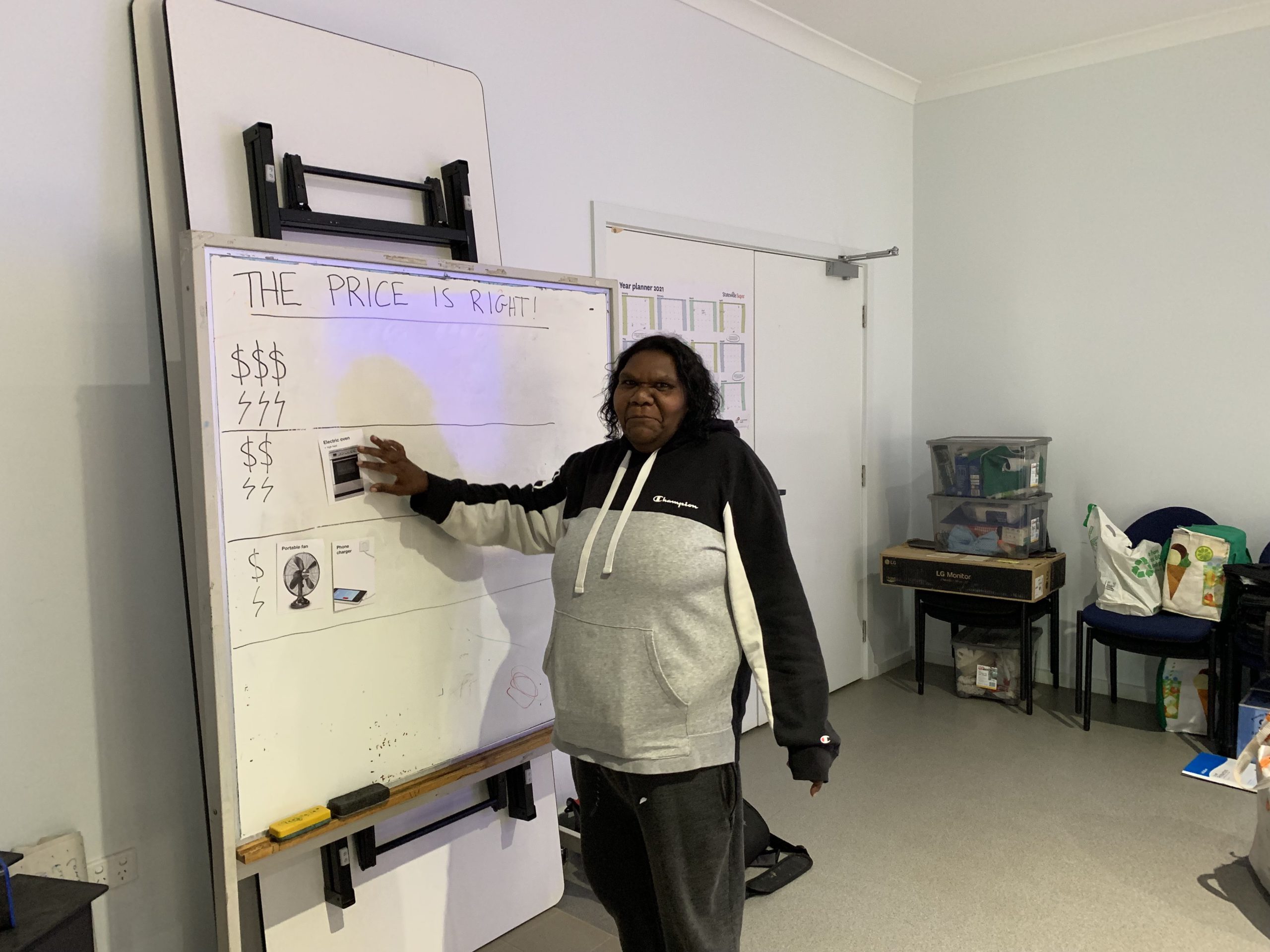

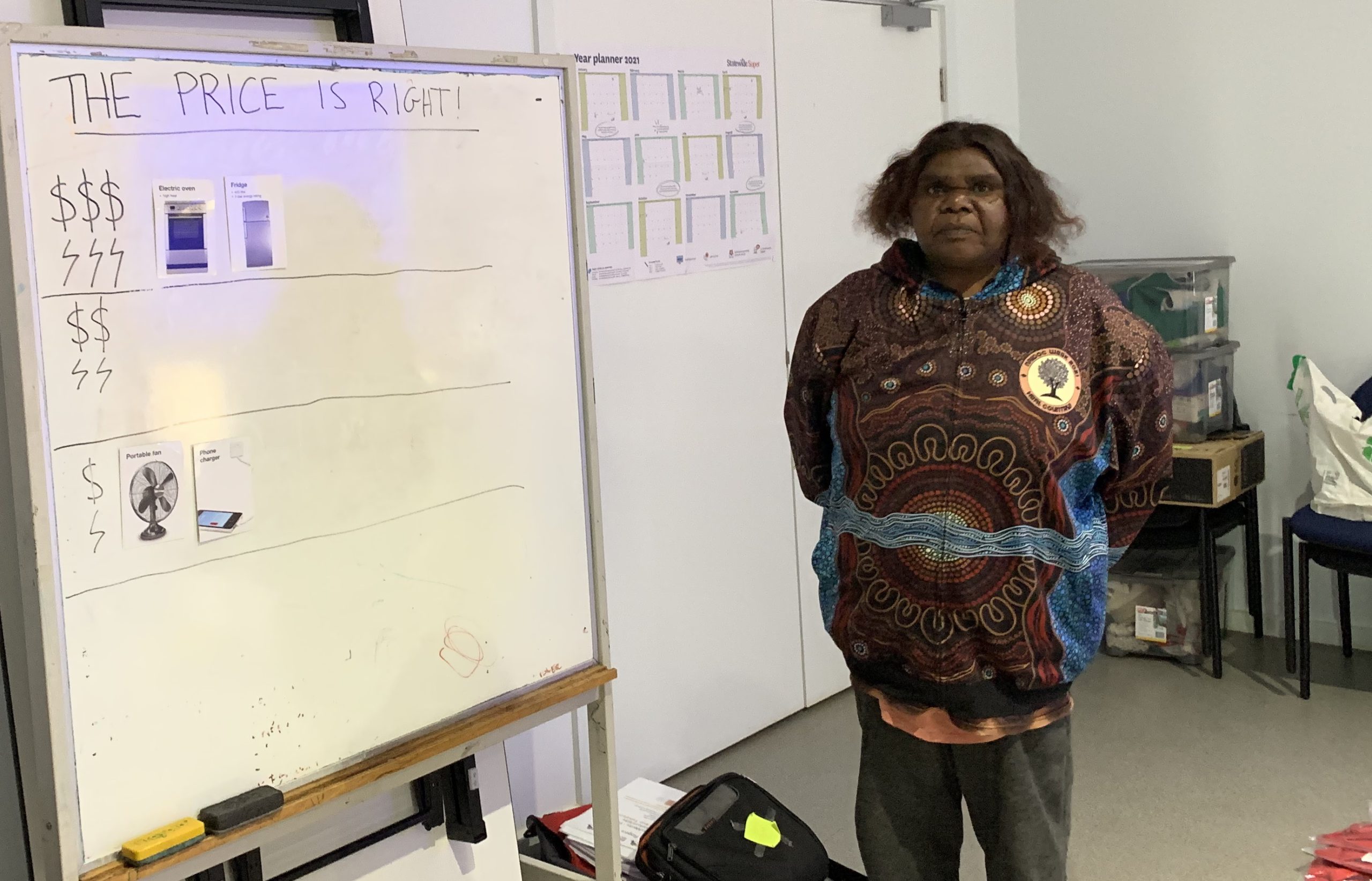

Yalata EEW team completes training

By Lisa Rogers Training was held at Scotdesco (Tjilkaba) Community from Monday 8th to Friday 12th November 2021. On Monday afternoon Lisa and Lucas picked up the seven newly recruited Energy Education Workers (EEWs) from Yalata and drove them to the Scotdesco Training...

Energy Education Worker Spotlight – Denise Baker

Employee Name: Denise Baker Residential Community: Yalata How long have you been with the Pawa Atunmankunytjaku team? Since November 2021 What does your job entail? Door knocking and teaching community people about the paid power Who and what inspired you to join the...